iowa state income tax calculator 2019

Enter the amount of your Iowa EITC on lines 61 62 65 66 and 67. The following tax calculation provides an overview of Federal and State Tax payments for an individual with no children and no special circumstances living in Iowa.

Best States For Low Taxes 50 States Ranked For Taxes 2019 Kiplinger

The Iowa expanded instructions for lines 14 and 18 of the IA 1040 set forth the Departments guidance for the correct reporting of these amounts.

. SmartAssets Iowa paycheck calculator shows your hourly and salary income after federal state and local taxes. The top marginal rate of 98 will remain in place until 2022. Use our Withholding Calculatorto review your W-4.

Fields notated with are required. You can produce a. The following tax calculation provides an overview of Federal and State Tax payments for an individual with no children and no special circumstances living in Iowa.

You can produce a. The Iowa tax calculator is updated for the 202223 tax year. How to calculate Federal Tax based on your Annual Income.

The IA Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow for single joint. The states income tax rates range from 033 to 853. 15 Tax Calculators 15 Tax Calculators.

You can produce a. The following tax calculation provides an overview of Federal and State Tax payments for an individual with no children and no special circumstances living in Iowa. You can produce a.

The following tax calculation provides an overview of Federal and State Tax payments for an individual with no children and no special circumstances living in Iowa. If you would like to update your Iowa withholding. Income included to determine exemption.

2021 Tax Year Return. Paycheck calculators by state Iowa state income tax Iowa has a population of over 3 million 2019 and is the leading producer of corn in the world second to China. Iowa is used as the default State for for this combined Federal and State tax calculation you can choose an alternate State using the 2019 State and Federal Tax calculator.

Corporations in Iowa pay four different rates of income tax. Federal or IRS Taxes Are Listed. Iowa net income line.

The Iowa Income Taxes Estimator Lets You Calculate Your State Taxes For the Tax Year. The 2019 Tax Calculator uses the 2019 Federal Tax Tables and 2019 Federal Tax Tables you can view the latest tax tables and. The Iowa State Tax Tables for 2019 displayed on this page are provided in support of the 2019 US Tax Calculator and the dedicated 2019 Iowa State Tax Calculator.

The following items must be included when determining if you are eligible for the 9000 exemption. Nonresidents and Part-year Residents The Iowa EITC must be adjusted using the following formula. We also provide State Tax.

However the rates will be gradually reduced to meet the revenue. The following tax calculation provides an overview of Federal and State Tax payments for an individual with no children and no special circumstances living in Iowa. Additional withholding cannot exceed your taxable wages less your federal withholding for a pay period.

Multiply federal adjusted gross. You can produce a. Iowa is used as the default State for for this combined Federal and State tax calculation you can choose an alternate State using the 2019 State and Federal Tax calculator.

Income Tax Changes For 2019 Ag Decision Maker Iowa State University Extension And Outreach

Earned Income Tax Credit Overview

37 States Don T Tax Your Social Security Benefits Make That 38 In 2022 Marketwatch

Minnesota State Income Tax Mn Tax Calculator Community Tax

Iowa Paycheck Calculator Smartasset

Your 2020 Guide To Tax Deductions The Motley Fool

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

State Corporate Income Tax Rates And Brackets Tax Foundation

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Annual Tax Calculator Us Icalculator 2022

Pennsylvania Tax Rate H R Block

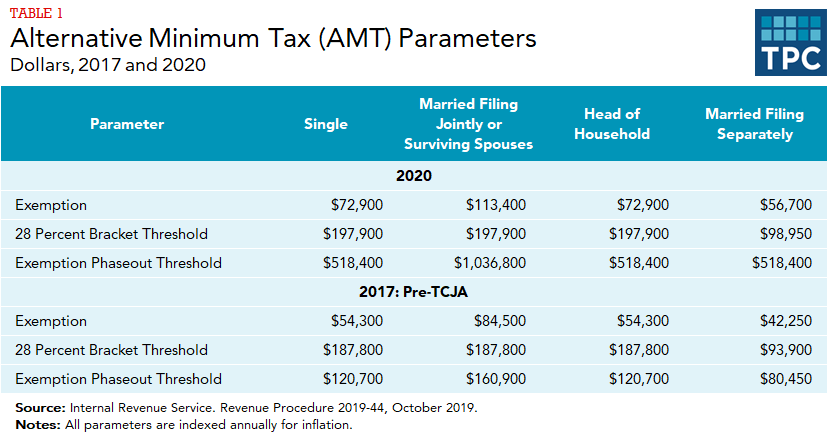

What Is The Amt Tax Policy Center

Income Tax In The United States Wikipedia

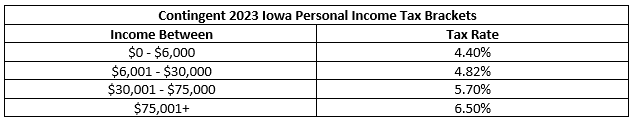

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

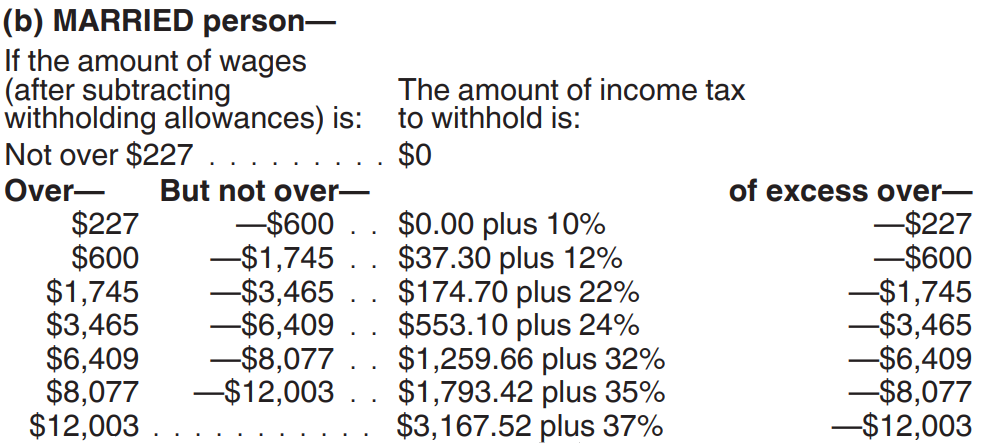

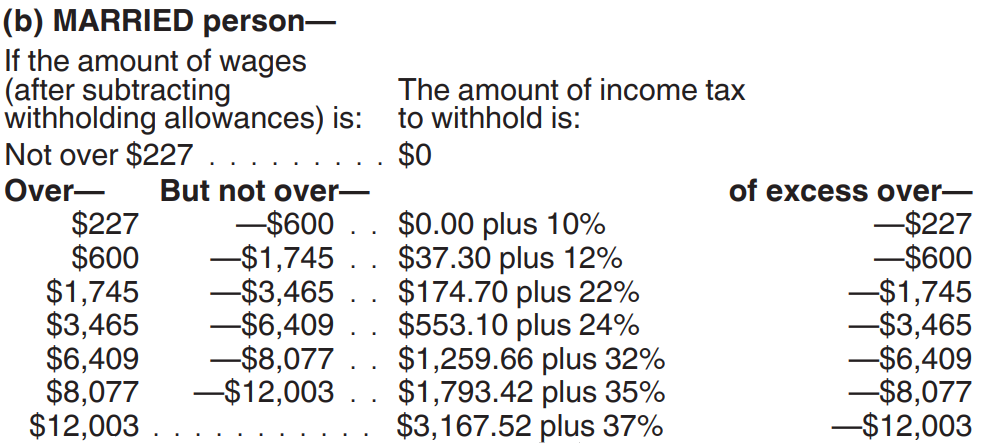

How To Calculate Payroll And Income Tax Deductions Peo Human Resources Blog

Tax Withholding For Pensions And Social Security Sensible Money